As a financial analyst, the balance sheet is one of the most critical financial statements I analyze. It provides a comprehensive snapshot of a company’s financial health at a given time. One key feature of balance sheets is the classification of assets and liabilities into current and noncurrent categories, which is immensely helpful in evaluating liquidity and solvency. In this guide, I’ll explain why a classified balance sheet shows subtotals for current and current, what classified balance sheets are, why classification matters, how to interpret current and noncurrent subtotals, and key analysis ratios. Let’s dive in!

What Is a Classified Balance Sheet?

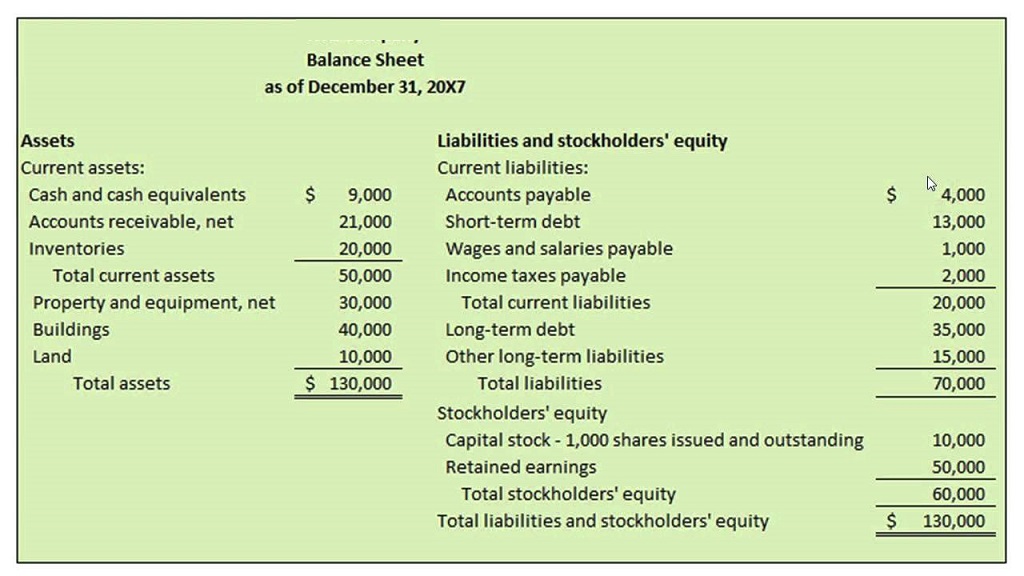

A classified balance sheet separates assets and liabilities into short-term (current) and long-term (noncurrent) categories. This classification is based on the expected period for converting assets to cash and for liabilities to become due and payable. Current assets are resources a company wishes to use or convert within one year, while current liabilities are obligations coming due within one year. Noncurrent assets and liabilities are those with longer time horizons beyond one year.

The distinction between current and noncurrent provides vital information about a company’s liquidity – its ability to pay bills and other short-term obligations. If a company has insufficient assets to cover its current debts, it could face liquidity issues. The classification also highlights solvency – the ability to pay long-term obligations. I always examine the current and noncurrent subtotals closely when analyzing balance sheets.

Why A Classified Balance Sheet Shows Subtotals for Current and Current?

A classified balance sheet shows subtotals for current and noncurrent assets and current and noncurrent liabilities. This classification gives users important information about an organization’s liquidity and solvency. Existing assets and liabilities are expected to be realized or settled within the normal operating cycle of the business, typically one year. Noncurrent assets and liabilities are those with longer-term implications. The subtotals for current and noncurrent items help financial statement users assess an organization’s short-term and long-term financial position and make informed decisions.

Why Does the Classification Matter?

Simply presenting total assets and total liabilities doesn’t provide the complete picture of timing and future cash flows. The separation into current and noncurrent based on expected use or payment windows is crucial to assessing liquidity and solvency. Here are some key reasons why:

- Evaluating short-term liquidity – Subtotals spotlight assets that can quickly become cash to pay current bills coming due within 12 months. Is the company’s cash and accounts receivable robust enough to handle imminent obligations?

- Assessing risk of default – A company with a sizeable short-term debt load approaching the total current assets on hand could show signs of financial distress. The classification highlights potential issues.

- Estimating future working capital – By comparing current asset and liability subtotals, you can estimate working capital needs in the coming year based on the timeline of converting assets or fulfilling obligations.

- Forecasting solvency – The distance between current subtotals and total assets/liabilities shows future long-term capital resources and obligations after short-term needs are met.

- Analyzing trends over time – Looking at changes in current and noncurrent subtotals each period reveals trends in the timing of assets/liabilities and overall financial health.

Without separating into current and noncurrent, you miss out on these vital insights and risk misjudging short and long-term financial strength!

Key Current Asset Categories

On the asset side, here are the main current asset accounts and what they represent:

- Cash and cash equivalents include cash on hand, bank deposits, and highly liquid investments like money market funds. This is the most liquid asset.

- Marketable securities are short-term securities that can readily be converted to cash, like T-bills maturing in less than one year. They are less liquid than cash but very close.

- Accounts receivable are money owed by customers for sales of goods/services. They can take 30-90 days to convert to cash.

- Inventory includes raw materials, work-in-progress, and unsold finished goods. It can take several months to sell and is a less liquid asset.

- Prepaid expenses are expenses paid for in advance, like insurance, that will amortize over the next year. They are not a cash-like asset.

Adding up these near-term resources shows the liquidity cushion to pay current obligations due this year without interruption. A weak current asset total is a red flag for potential shortfalls.

Key Current Liability Categories

For current liabilities that must be paid within 12 months, the main accounts are:

- Accounts payable – Money owed to suppliers/vendors for inventory, services, equipment, etc. One of the most significant current liabilities is that these are typically due in 30-60 days.

- Accrued liabilities – Expenses incurred but not yet billed, like wages owed to employees. These hit quickly as obligations.

- Short-term debt – Debt obligations like loans and notes payable that mature within the next year are often a major area to cover.

- Current portion of long-term debt: Principal payments on long-term debt are due within 12 months. This can be sizeable.

- Income taxes payable – Income taxes owed to the government coming due in the next year.

- Unearned revenue – Cash received in advance before providing goods/services to customers and eventually converted to revenue.

Tracking obligations due against liquid resources on hand is vital for any company. The current liability subtotal is an essential measure of solvency risk in the near term.

Noncurrent Assets – Resources Beyond One Year

Shifting to longer-term assets, key noncurrent asset categories include:

- Fixed assets – Long-term property, plants, and equipment used in operations. These are depreciated over time. Less liquid than current assets.

- Intangible assets – Long-term assets lacking physical form, like patents, trademarks, copyrights, and goodwill. They are also amortized over time.

- Long-term investments – Investments intended to be held for long periods before sale, including equity investments. More illiquid.

- Other assets – Miscellaneous deferred charges and noncurrent receivables with more extended collection periods.

The distance between total current and total assets shows the extent of long-term capital resources tied up in slowly depreciating or amortizing assets to produce future revenues beyond just the next 12 months. Think of it as assets reserved for the long haul.

Noncurrent Liabilities – Obligations After One Year

Noncurrent liabilities are long-term corporate obligations beyond the current period:

- Long-term debt – Debt like bonds, loans, and notes that mature over 12 months. This has a significant claim on future assets.

- Deferred taxes are income taxes owed to the government that become due after one year, creating a future obligation.

- Pension liabilities are the net funded status of employee pension plans over the long run. They can be underfunded.

- Other liabilities – Deferred rent and environmental reserves represent long-term obligations.

The gap between current and total liabilities demonstrates capital locked up to service long-term debt and other obligations after meeting short-term commitments. Think claims on the future. A wide gap could limit reinvestment and growth.

Analyzing and Interpreting the Subtotals

Now that we’ve surveyed the critical current and noncurrent accounts let’s look at analytical techniques for interpreting classified balance sheets:

- Liquidity ratios – Current ratio (current assets/current liabilities) and quick ratio (quick assets/current liabilities) assess short-term liquidity strength. I like to see these above 1.0x.

- Working capital is current assets minus current liabilities. Positive working capital means a company can pay near-term obligations. However, too high working capital may indicate inefficient use of capital.

- Operating cycle – Timespan between buying inventory, selling goods, and collecting accounts receivable. This estimates liquidity needs flowing through current accounts each year.

- Cash conversion cycle: This measure Measures how fast short-term assets convert to cash to pay near-term liabilities. I examine trends over time.

- Solvency ratios – Debt/equity (total liabilities/shareholders’ equity) and long-term debt/equity assess the ability to meet long-term obligations. <1.0x is stronger.

- Capitalization – Comparing current, long-term, and equity portions shows how the company finances itself. I want to see a balance between short and long-term sources.

These metrics based on current and noncurrent subtotals provide tremendous insights you don’t get from an unclassified balance sheet. The classified format is infinitely more revealing.

Let’s walk through a sample classified balance sheet from accurate company financials to illustrate the current and noncurrent split in action:

Fiscal Year End Classified Balance Sheet

| Assets | |

| Current Assets: | |

| Cash | $5,000 |

| Accounts Receivable | $8,000 |

| Inventory | $10,000 |

| Prepaid Expenses | $2,000 |

| Total Current Assets | $25,000 |

| Noncurrent Assets: | |

| Property, Plant & Equipment | $20,000 |

| Less: Accumulated Depreciation | ($5,000) |

| Net Fixed Assets | $15,000 |

| Intangible Assets | $3,000 |

| Total Noncurrent Assets | $18,000 |

| Total Assets | $43,000 |

| Liabilities and Shareholders’ Equity | |

| Current Liabilities: | |

| Accounts Payable | $4,000 |

| Short-Term Notes Payable | $6,000 |

| Accrued Expenses | $3,000 |

| Total Current Liabilities | $13,000 |

| Noncurrent Liabilities: | |

| Long-Term Debt | $10,000 |

| Total Noncurrent Liabilities | $10,000 |

| Shareholders’ Equity: | |

| Paid-in Capital | $15,000 |

| Retained Earnings | $5,000 |

| Total Shareholders’ Equity | $20,000 |

| Total Liabilities and Equity | $43,000 |

In this example, the company has $25,000 in short-term liquid assets to cover the $13,000 current liabilities due within one year. The current ratio is 1.92x, which indicates good liquidity. Working capital is $12,000. The company has issued some long-term debt, but equity of $20,000 covers it. The debt/equity ratio is 0.5x, indicating the company is not overly leveraged. This is the power of the classified balance sheet on full display!

FAQs

Q: What is the difference between current assets and current liabilities?

A: Current assets are short-term resources expected to become cash within one year to fund operations. Current liabilities are financial obligations coming due within one year that must be paid. The relationship between the two highlights liquidity.

Q: How are noncurrent assets different from property, plant, and equipment?

A: Property, plant, and equipment are long-term fixed assets with physical substance. Noncurrent assets include fixed assets but also incorporate intangible assets and long-term investments without physical form that provide future benefits beyond one year.

Q: What happens if current liabilities exceed current assets?

A: A company wants current assets to exceed current liabilities to maintain adequate working capital. If current liabilities are greater, it indicates possible liquidity issues in being able to pay near-term obligations, and the company may need to seek additional financing.

Q: Why are some long-term debts included in current liabilities?

A: The principal portion of long-term debt obligations that must be paid within the next year is reclassified to current liabilities since the payment is approaching within 12 months. This provides a more accurate view of upcoming liabilities.

Q: Can noncurrent accounts shift to become current in the future?

A: The distinction between current and noncurrent is based on the remaining timing of conversion to cash for assets or payments coming due for liabilities. As time passes, some noncurrent accounts will eventually become current if the conversion or due date is approaching within 12 months.

The Takeaway on Current and Noncurrent Subtotals

Classifying assets and liabilities between current and noncurrent provides vital intelligence. In my role analyzing financial statements, it’s one of the first things I examine on any balance sheet. Exploring the question ‘Can Your Balance Help You Reach Financial Freedom?‘ requires a comprehensive analysis that goes beyond mere account figures; it involves a scrutiny of the separation spotlighting liquidity strength for short-term needs and long-term solvency. Additionally, understanding leverage to handle obligations beyond one year, along with maintaining proper ratios to observe trends over time, becomes instrumental in achieving lasting financial independence.

In closing, digging into the current and noncurrent subtotals helps answer critical questions: Can the company pay its bills in the next 12 months? How leveraged is it long-term? What tradeoffs is management making between short and long-term capital allocation? The granularity empowers sound interpretations and better financial decisions. That’s the beauty of a correctly classified balance sheet.